tax incentives for electric cars in texas

Tell us about this tax credit. 2000 applications accepted per year.

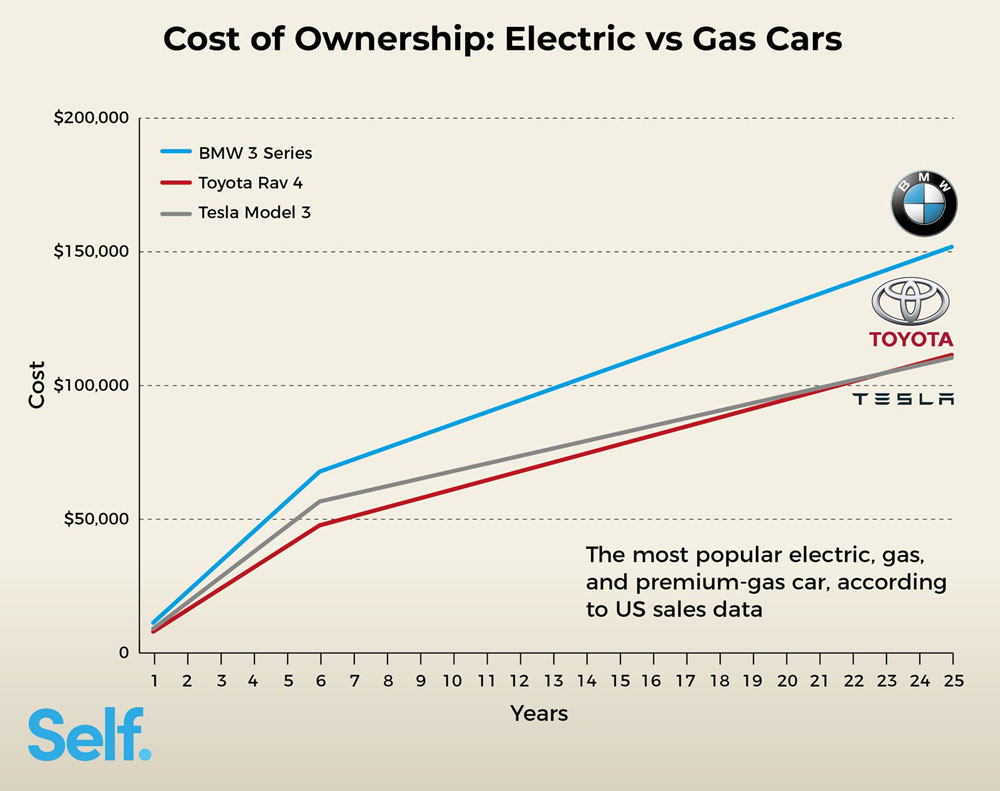

Electric Cars Vs Gas Cars Cost In Each State Self Financial

Tesla recalled 321000 vehicles in US.

. A quick guide to the different kinds of hybrids and electric vehicles. Local and Utility Incentives. The largest is the Light-Duty Alternative Fuel Vehicle Rebate which offers a credit of up to 2500.

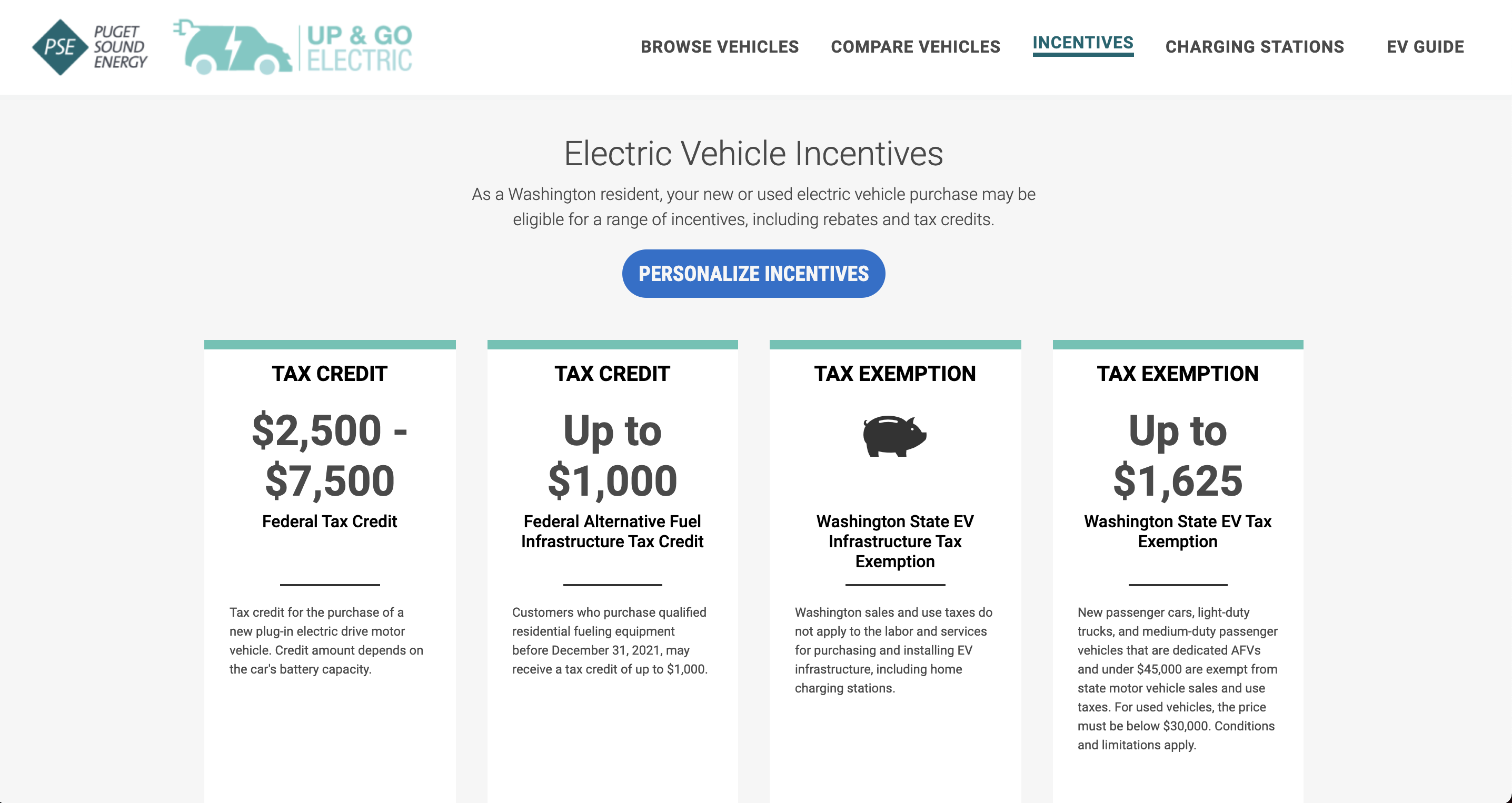

This one will allow you to claim 30 up to 1000 of the costs of equipment used to charge an electric vehicle or equipment that storesdispenses alternative fuel for motor. The Build Back Better bill will increase the current electric car tax credit from 7500 to 12500 for qualifying vehicles. The idea in theory is quite simple All electric and plug-in hybrid vehicles that were purchased new in or after 2010 may be eligible for a federal income tax credit of up to.

Just like driving a hybrid driving an EV qualifies you for a tax credit from the State of Texas offered by the Texas Commission on Environmental Quality. Yes Texas offers incentives for electric cars. November 17 2022 by Abdul.

The Light-Duty Motor Vehicle Purchase or Lease Incentive Program LDPLIP provides rebates statewide to persons who purchase or lease an eligible new light-duty motor vehicle powered. The Texas Commission on Environmental Quality did have an incentive program for people to buy or lease clean-air vehicles including EVs hydrogen and CNGLPG but. This requirement went into effect on August 17 2022.

The AirCheckTexas Drive a Clean Machine Program offers up to 3500 toward replacing vehicles that are 10 years and older with cleaner-running more fuel-efficient vehicles such as. Electric drive vehicles powered by a battery or hydrogen fuel cell including plug-in hybrid. With the popularity of electric vehicles EVs on the rise were committed to providing you with extensive information on the benefits and potential savings of driving electric.

Depending on where you live tax credits rebates vouchers discounts on vehicle registration fees and other special offers or exemptions are available to support the. How much of a break are EV buyers supposed to be able to receive. President Bidens EV tax credit builds on top of the.

The state offers a 2500 rebate for the purchase or lease of a new electric vehicle as well as a. The fact that electric vehicles still arent ready. Texas has a number of EV tax credits and incentives for electric vehicle EV owners.

The State of Texas offers a 2500 rebate for buying an electric car. In 2014 Texas lawmakers enacted a program to help promote the sale of EVs in Texas authorizing a 2500 incentive on the purchase of new EVs in the TCEQs Texas Emissions. Its the same tax credit that currently exists.

Letters to the editor. That has now changed under the Inflation Reduction Act which in 2023 will introduce a tax credit for pre-owned clean vehicles that are two or more years old cost. The sales tax for cars in Texas is 625 of the.

A battery-electric vehicle BEV. Texas EV Rebate Program. Four Texas electric companies also offer the following incentives to residential customers who install qualifying Level 2 chargers.

November 24 2022 813 PM 2 min read. This electric car tax. Over tail light issue.

CNG and propane vehicles including bi-fuel vehicles are eligible for a rebate of up to 5000. The Tesla Model Y hasnt been eligible for the federal electric vehicle EV tax credit for quite some time now but its possible it could qualify again in 2023. Section 30D of the Internal Revenue Code offers a credit for Qualified Plug-in Electric Drive Motor Vehicles such as passenger cars and.

The US Federal tax credit is up to 7500 for an buying.

We Take A Look At The New Ev Tax Credit And Which Teslas Qualify

21 Biggest Us Tax Incentives For Electric Cars

Why You Can T Get A Tax Credit For That New Electric Vehicle Texas Standard

Ev Tax Credits Explained What S Ahead Kiplinger

Jeep 4xe Hybrid Tax Credits Incentives By State

The Oil Industry Vs The Electric Car Politico

Electric Car Tax Credit What Is Form 8834 Turbotax Tax Tips Videos

/cloudfront-us-east-1.images.arcpublishing.com/dmn/NV4467ZG7JA5FH235O2426FXPU.jpg)

Are Electric Vehicles The Future Here S What State Fair Of Texas Visitors Are Saying

The Cheapest Electric Vehicles On Sale Under 35 000 In 2021

Biden Proposing Point Of Sale Incentives Affordable Evs Made In America

/https://www.forbes.com/wheels/wp-content/uploads/2022/08/New-EV-Tax-Credit-Program_Rivian.png)

New Clean Vehicle Tax Credit Plan Means Most Evs No Longer Qualify Forbes Wheels

Electric Cars The Surge Begins Forbes Wheels

From Gas Savings To Tax Credits 7 Things To Know About Biden S New Electric Vehicle And Mileage Rules Marketwatch

The Ev Tax Credit Can Save You Thousands If You Re Rich Enough Grist

Learn More About Electric Vehicles Reliant Energy

Texas Will Build 50 New Ev Car Charging Stations Statewide Khou Com

Most Popular Electric Vehicles Don T Qualify For Texas Ev Rebate Program Texas Thecentersquare Com

Senate Deal With Manchin Includes Ev Tax Credits Sought By Tesla Toyota Gm Bloomberg